Amphitheater

1.000.000 Tomans

(Waived for graduate students with good standing.)

July 31, 2023 (9 Mordad 1402)

Mohammad Morovati

- Mohammad Reza Mousavi

- Hossein Hojjat

Fereshte Allahverdi

Executive Chair

Fereshte Allahverdi

Scientific Chair

Sahber Ahmadi-Renani

Organization Chair

Amin Hamzehali

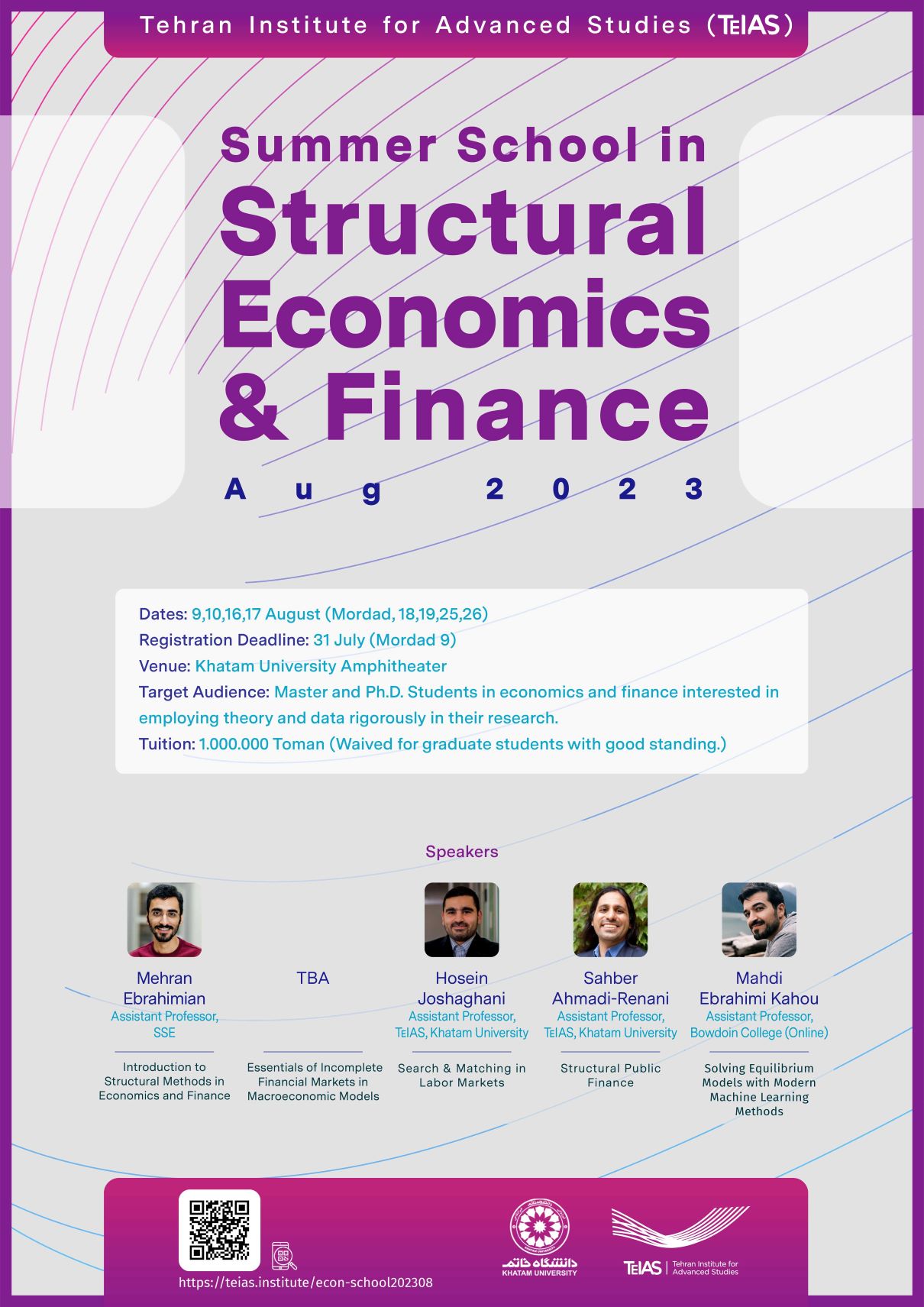

Overview

Structural models are an integral part of empirical analysis in economics and finance. Structural models offer a unique way to understand data, analyze mechanisms, and evaluate policy counterfactuals. With innovations in big data, computational tools, and numerical methods, their applications are only growing. In this summer school, we review the basics of identification and estimation of structural models along with various areas of economics and finance that benefit from the use of structural methods, such as interbank lending markets, unemployment, and family taxation.

Target Audience

Master and Ph.D. Students in economics and finance interested in employing theory and data rigorously in their research.

Speakers

Mehran Ebrahimian

Assistant Professor

SSE

TBA

Title: DyNetKAT: An Algebra of Dynamic Networks

Abstract. In this talk I will introduce DyNetKAT -a formal language for specifying dynamic updates for Software Defined Networks. The latter can play an important role in solving issues concerning big data applications, including data processing in cloud data centers, optimisations and data delivery. DyNetKAT builds upon Network Kleene Algebra with Tests (NetKAT) and adds constructs for synchronisations and multi-packet behaviour to capture the interaction between the control- and data plane in dynamic updates. A sound and ground-complete axiomatisation of DyNetKAT will be discussed, together with an efficient method for reasoning about safety properties, and associated case studies.

Title: Causal Reasoning in Systems

Abstract. Causal inference plays an important role in assessing why did a hazardous situation occur and how certain undesired scenarios could have been avoided, or when performing fault localisation in systems, amongst others. In this talk I will introduce a notion of “actual causality”, proposed by Joseph Halpern and Judea Pearl in their seminal work “Causes and explanations: A structural-model approach”. An adoption to the setting of transition systems and, implicitly, DyNetKAT models, will be discussed as well. As we shall see, causal inference for DyNetKAT enables addressing interesting questions such as Reachability: “Can host A communicate with host B? Can every host communicate with every other host?”, or Security: “Does all untrusted traffic pass through the intrusion detection system located at C?”.

Hosein Joshaghani

Assistant Professor

TeIAS

Sahber Ahmadi-Renani

Assistant Professor

TeIAS

Mahdi Ebrahimi Kahou

Assistant Professor

Bowdoin College (Online)

Schedule

1:00-3:00 & 3:30-5:30 Introduction to Structural Methods in Economics and Finance

Mehran Ebrahimian

9:00-11:00 Essentials of Incomplete Financial Markets in Macroeconomic Models

TBA

11:00-1:00

Launch and Break

1:00-3:00 Essentials of Incomplete Financial Markets in Macroeconomic Models

TBA

9:00-11:00 Search and Matching in Labor Markets

Hosein Joshaghani

11:00-1:00

Launch and Break

1:00-3:00 Search and Matching in Labor Markets

Hosein Joshaghani

9:00-11:00 Structural Public Finance

Sahber Ahmadi-Renani

11:00-1:00

Launch and Break

1:00-3:00 Structural Public Finance

Sahber Ahmadi-Renani

3:30-5:30 Solving Equilibrium Models with Modern Machine Learning Methods

Mehdi Ebrahimi Kahou